Why Invest in Emerging Markets?

Emerging Markets (EM) equities are trading at the cheapest valuations relative to Developed Markets in 50 years1.

Gain exclusive access to a proven strategy that invests in high-quality, EM growth companies with a strong focus on downside protection.

A hand-picked emerging markets portfolio

Northcape Capital is one of Warakirri’s boutique asset managers with a long history of managing equities for Australian institutional investors. Investors can access Northcape’s expertise exclusively via the Warakirri Global Emerging Markets Fund.

Proven performance track record

Northcape invests in resilient businesses with clear opportunities for growth and has delivered sustained investment outperformance over the long term2.

Integration of ESG mitigates risk

ESG leading companies have historically outperformed, especially in emerging markets3. Northcape sets the bar high for companies to pass its ESG test and scoring system before being considered for addition to the portfolio.

Why Emerging Markets Now?

Watch the videos below with Ross Cameron, Portfolio Manager, Emerging Markets Equities at Northcape Capital, manager of the Warakirri Global Emerging Markets Fund, to learn more about the opportunities available now in the asset class and why specialist active management plays a crucial role in generating superior investment returns.

The Proof is in the Process

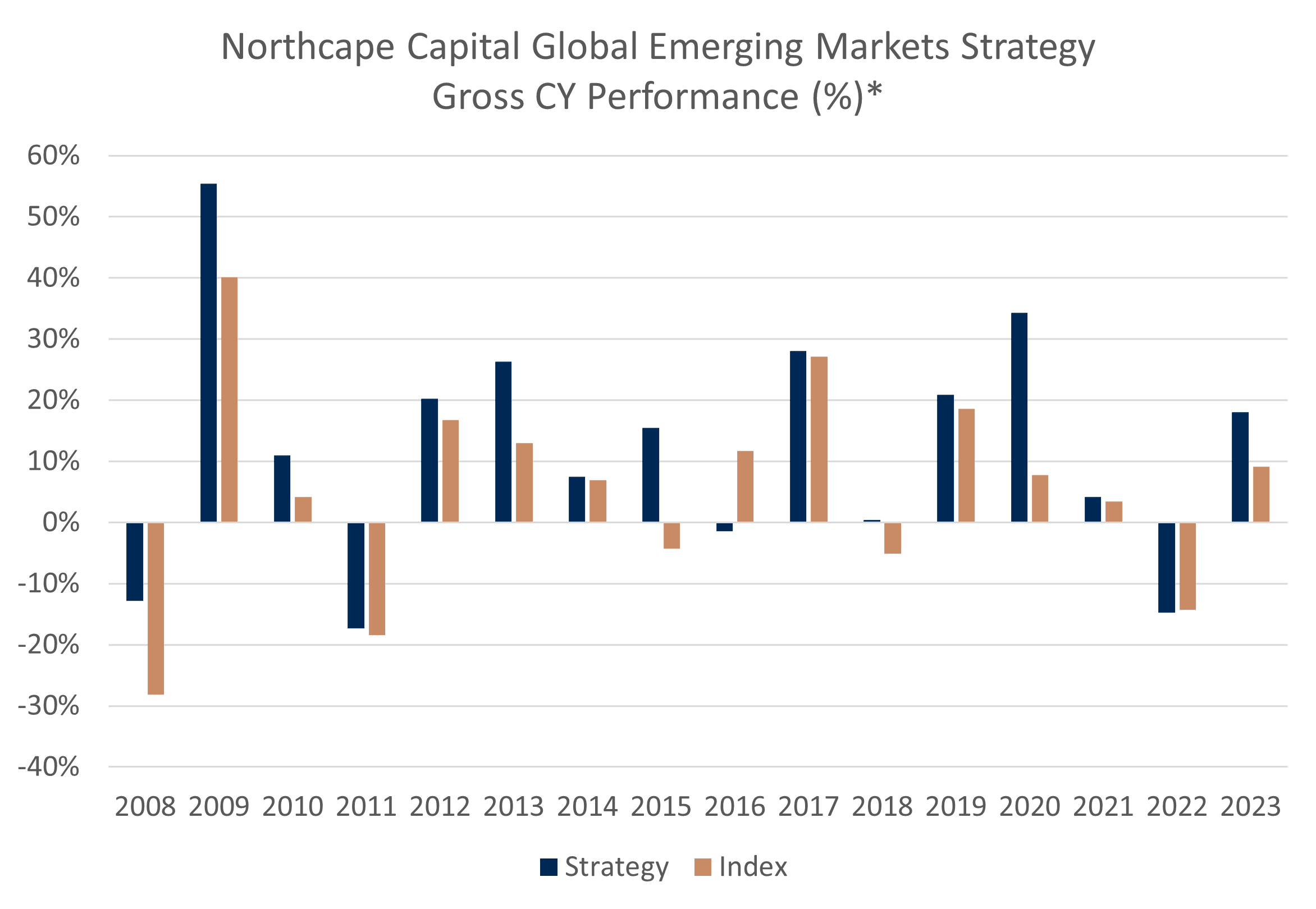

Resilient and Sustained Long-Term Portfolio Outperformance

Northcape’s highly disciplined, index unaware, “Best of the Best” ideas strategy has yielded strong, resilient returns over the long term. In fact, their investment approach has experienced only two calendar years of underperformance since the strategy’s inception in 2008.

Managing downside risk is critical for successful investing in Emerging Markets. Northcape’s strong risk management approach which starts with the critically important identification of sovereign risk and their quest for ESG excellence – only investing in companies that adhere to sound environmental, social and corporate governance practice – ensures a focus on the protection of investor’s capital.

* Source: Northcape Capital. Inception date of the Northcape Capital Global Emerging Markets Strategy is 1 July 2008. Calendar Year returns shown are gross of fees and taxes. Index is the MSCI Emerging Markets Accumulation Index ($AUD). Read More.

Zenith Investment Partners noted that the fund is “well-managed by an experienced investment team adopting a differentiated investment approach”. “Historically, Northcape’s investment approach has resulted in solid participation in rising markets whilst offering strong downside protection. Zenith considers the Fund’s performance profile to be a key attraction.”

Lonsec highlights a strength of the fund as the “highly detailed research approach which places a high degree of emphasis on downside protection with notable integration of ESG considerations.” “The process incorporates a sovereign risk framework into decision making which have historically been important drivers of emerging markets risk.”

LEARN MORE ABOUT THE WARAKIRRI GLOBAL EMERGING MARKETS FUND

Fund Resources

Want to learn more?

- Source: BofA Global Research.

- Source: Northcape Capital. Performance refers to the Northcape Capital Global Emerging Markets Strategy and is gross of fees. Inception date 2008. Past performance of the Northcape Capital Global Emerging Markets Strategy is not representative of the performance of the Warakirri Global Emerging Markets Fund which has an inception date of July 2020. Past performance is not necessarily indicative of future performance.

- Source: Jefferies Research.

The Warakirri Global Emerging Markets Fund is issued by Warakirri Asset Management Limited (ABN 33 057 529 370) (Australian Financial Services Licence Holder No. 246782). This website is maintained by Warakirri Asset Management and provides general product information only and does not constitute financial advice as it does not take into account an individual’s objectives, personal situation or needs and is not an offer or solicitation to enter into an agreement. Investors should not rely on the information on this website without first referring to the Fund’s Product Disclosure Statement (PDS), Additional Information Booklet and the Target Market Determination (TMD) for a description of the target market and seek independent advice from their financial adviser. A PDS for the Fund is available on this website or by calling 1300 927 254. The PDS should be considered before making an investment decision. Investments entail risks, the value of investments can go down as well as up and investors should be aware they might not get back the full value invested. Portfolio holdings are subject to change. Past performance is not a reliable indicator of future performance. Investment decisions should not be made upon the basis of the Fund’s past performance or distribution rate, since each of these can vary.

Fund Ratings Important Information

Ratings are only one factor to be taken into account when deciding whether to invest.

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned WRA4779AU November 2023) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.

The rating issued May 2024 is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2022 Lonsec. All rights reserved.

This website is intended for Australian investors only. Information on this website may not be suitable for all investors and clients. By using this website you agree to and acknowledge the Terms of Use. Click here to view Terms of Use.