Emerging Markets: Themes that have our attention

14 August 2024

Here our specialist Emerging Markets Equities investment partner, Northcape Capital, examines the current themes that have their attention, and where they see the risks and opportunities for the asset class.

This information has been prepared by Northcape Capital, the underlying investment manager for the Warakirri Global Emerging Markets Fund.

Opportunities and Risks in Emerging Markets (EM)

In addition to the usual risks that we assess at the company and sovereign levels, there are a range of themes that currently have our attention with respect to our portfolio positioning.

Industry consolidation is driving increased pricing power and return on equity for industry leaders

In our view the days of zero interest rates (free money) are gone for a few years at least. At a macroeconomic level it clearly seems to us that interest rates will stay higher for longer and will put a limit (or much higher cost) on the supply of capital to start-ups and/or businesses with negative free cashflows.

This is especially the case in Emerging Markets (EM) where interest rates are generally much higher than in US, Europe and Japan. This will enhance the competitive position of the leading EM companies which have strong free cashflows, a fully funded business model, and will enable them to grow their market share by reinvesting in their business at a higher rate than their poorly funded competitors. This should drive industry consolidation, improving pricing power (delivering a better hedge against inflation) for the market leaders.

Returns on capital for leading EM companies, to which the portfolio is strongly biased, should also increase and therefore support higher valuations. In fact, as we look at the portfolio as at 30 June 2024, 79% of companies (26 out 33) are ranked number one by market share in their respective categories. This highlights how dominant this theme is in our EM strategy.

AI benefitting North Asian semiconductor industry

From our assessment in North Asian semiconductor stocks, they are well placed to benefit as mission critical suppliers of AI chips. TSMC (currently 10% of the portfolio) is the undisputed leader in logic chips, with only one main foundry competitor, Samsung Electronics. However Samsung is more focused on DRAM memory, and its logic chips are not as well positioned at the leading edge as TSMC.

TSMC will also potentially continue to take market share from Intel, again due to the fact it has superior logic chip technology. Indeed, it is possible over the long-run Intel may fully abandon its own chip making and outsource its manufacturing to TSMC.

Samsung Electronics (circa 7% of the Fund’s portfolio) and SK Hynix (5% of the portfolio), likewise, will continue to benefit from the AI boom for DRAM chips, and we have presently slanted the weighting towards Samsung Electronics given it has a more favourable valuation than SK Hynix. Crucially all of these companies will also benefit from the US Chips Act.

Supply Chain Relocation from China

The advent of COVID was a seminal event, which recognised the folly of having a supply chain overly exposed to one country, such as China. Furthermore, by way of how and where protein is processed in China, there is an ongoing risk of another pandemic emanating from this country.

This coupled with the US “economic, investment and trade divorce” with China is leading to more distributed global supply chains, that are not dependent on any one country. In our view the key EM beneficiaries of the redistribution of supply chains from China will be Vietnam, Malaysia, Indonesia, India and especially Mexico.

This will assist technology transfer and growth of these countries and impede China’s growth. India, Indonesia and Mexico are key overweights in the Fund’s portfolio, whilst China is a deep underweight.

Demographics

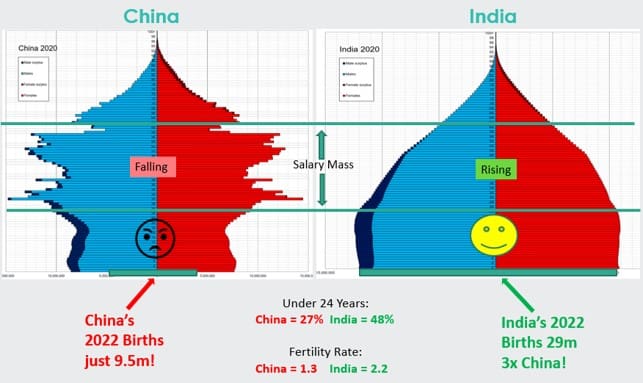

The Fund’s exposure is heavily weighted towards countries where salary mass (i.e. the number of people employed multiplied by average weekly earnings) and household formation are both growing.

As can be seen in the exhibit below, China’s salary mass is in structural decline and will worsen with its extremely low fertility rate (approaching 1). As such salary mass and household formation is falling in China, which creates an awful headwind for domestic demand.

Exhibit 1: Sovereign Risk – China V India: Demographics

Long-term sales growth for domestic China companies is set to fall, and materially in our view. This will have a profoundly negative impact on the valuation of China’s companies, as the terminal value is substantially depleted by a much lower sales level.

Conversely countries with favourable population pyramids and healthy fertility rates will potentially have very strong growth in salary mass and household formation, thus driving robust consumption growth for decades ahead.

This is a massive long-term “tailwind” for sales growth of the companies addressing these countries. Essentially the company’s sales base in the terminal year (10 to 20 years out) is set to be substantially higher, thus supporting a vastly higher stock valuation over time. This is a so called “demographic dividend”.

However, this dividend is not omni-present in EM. The selected few that are best placed in our view are India, Indonesia and Mexico, whilst having other important and favourable characteristics. These countries are key overweights in the Fund, whilst China is a deep underweight.

If Donald Trump is elected US President, it’s another headwind for China

Current polling has Donald Trump leading in the seven battleground states. According to New York Times analysis, if an election were held with current polling, Trump would be elected with over 300 electoral college votes (272 required to win). Trump is a more “transactional” person, and less inclined to comply with the “rules-based global order” and “multi-lateral” agreements.

The main risk for EM is China where Trump plans to impose a 60% tariff on all goods imported from the country. A general 10% tariff would be applied to all imports.

Trump has also mentioned that 11 million undocumented immigrants currently residing in the US would be deported, tax cuts would not be rolled back, and a potential change in leadership of the US Federal Reserve.

We do not see Trump reversing the Chips Act, materially modifying the USMCA or radically changing the Inflation Reduction Act (IRA). In our view these policies (plus the 60% tariff) will be very damaging for China, inflationary for the US, and potentially negatively impact global growth by reducing trade flows.

The relative winners would be countries that have underlying strong demand of their own, supported by favourable demographics and/or investment flows, and technology access, especially to leading edge chips.

Indeed, the continuation of Biden’s Chips Act alone, in our view will restrict China’s technological development.

Taiwan is strategically important to the US

Given all the leading-edge AI related semiconductor chips are still made in Taiwan by TSMC, the US, even under Trump, will still provide a strong umbrella of protection for the island state, in our view.

The US cannot afford China getting around the Chips Act by taking over Taiwan and commandeering TSMC’s leading-edge foundries, then using the technology in military applications against the US and its allies. As such we do not see Trump’s election being unduly negative for Taiwan and TSMC. In short, Democrats or Republicans are both big headwinds for China geopolitically. This is a factor in our current low weighting towards China, in addition to others mentioned.

Conclusion

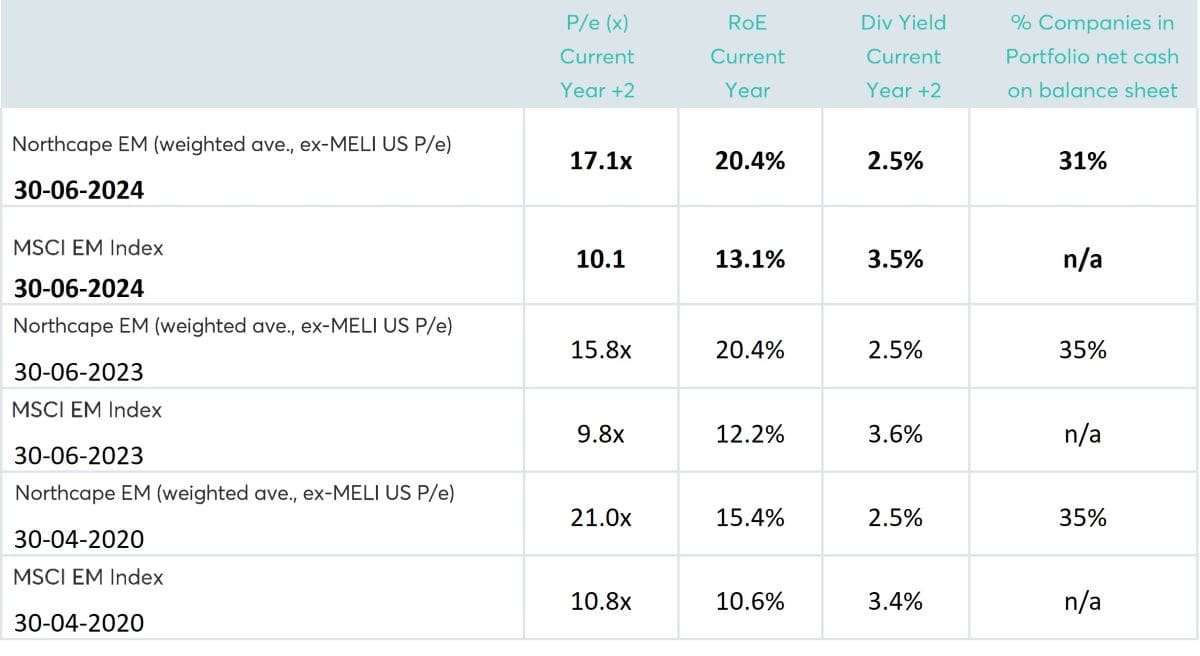

The Fund has a significant bias to quality, which has been hit by higher interest rates and has impacted valuation over the past twelve months. A sign of the valuation decline is seen in Table 1 below, where we can see the forward P/E of the portfolio was 17.1x as at 30 June 2024.

The 2024 forward P/E is broadly in line with our average since inception and compares with a portfolio P/E of 21.0x as of 30 April 2020 (the most recent high), and a P/E of 15.8x a year ago (close to our low point).

The RoE has improved over the past four years from 15.4% to 20.4% and is well above the MSCI EM Index RoE of 13.1%.

We believe that as interest rates start to fall as inflation ebbs, we are likely to see P/E expansion in our portfolio valuations once again. And when combined with solid earnings growth this should give rise to very robust prospects of good capital growth over the medium term.

It is worth noting that based on our current conservative assumptions all our major positions are currently undervalued, and some materially.

Table 1: Northcape EM Portfolio c.f. MSCI EM Index as at 30 June 2024, 30 June 2023 and 30 April 2020

For more information, please contact us on 1300 927 254 or visit Warakirri Global Emerging Markets Fund.

The information in this document is published by Warakirri Asset Management Limited ABN 33 057 529 370 (Warakirri) AFSL 246782 and issued by Northcape Capital ABN 53 106 390 247 AFSL 281767 (Northcape) representing the Northcape’s view on a number of economic and market topics as at the date of this report. Any economic and market forecasts presented herein is for informational purposes as at the date of this report. There can be no assurance the forecast can be achieved. Furthermore, the information in this publication should only be used as general information and should not be taken as personal financial, economic, legal, accounting, or tax advice or recommendation as it does not take into account an individual’s objectives, personal financial situation or needs. You should form your own opinion on the information, and whether the information is suitable for your (or your clients) individual needs and aims as an investor. While the information in this publication has been prepared with all reasonable care, Warakirri and Northcape do not accept any responsibility or liability for any errors, omissions or misstatements however caused.