Time to consider an investment in Australian Agriculture?

26 March 2024

Investment portfolios typically have minimal exposure to agriculture and the primary production of food. This is likely not helped by the fact that the benchmark S&P/ASX 200 equity index has less than 1% exposure to agricultural companies and many of these have limited investments in agricultural real-assets.

In addition to the solid long-term or “secular” demand outlook for agriculture, there are other compelling reasons for investors to consider some agricultural exposure as part of a well-diversified investment portfolio.

Introduction

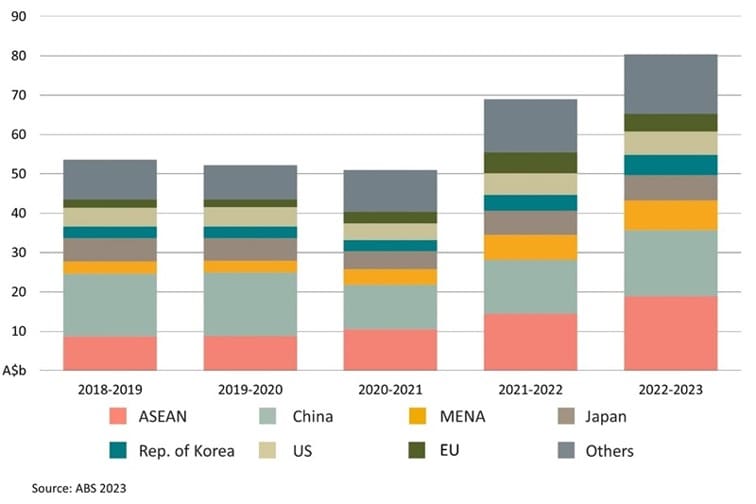

Australia is an important part of the global food supply chain. With the world’s fastest growing population, Asia, on our doorstep, rising global consumption and good export channels to the rest of the world, the demand for our food is rising. Australia is recognised for its clean, green and high-quality agricultural products, complementary seasons to Europe and North America for many products, free-trade and market access agreements with many important trade partners.

The predicted growth in food demand over the coming decades creates significant opportunities for Australian agriculture. The local industry is in a strong position to meet this rising demand and Australia has a comparative advantage in both the production of many agricultural products and our proximity to key markets.

Like many markets, agricultural prices vary between years and cycles – largely reflecting supply-demand economics. However, underlying demand for agricultural real-assets and food products continues to grow and this trend is likely to remain for years ahead.

Value of Australia’s agriculture, fisheries and forestry exports by destination, 2018–23

Another key driver which is sometimes overlooked, is the rising corporatisation of Australian agriculture and the demand for, and availability of, capital which is providing investors with significant opportunities to access the sector.

This capital access among other things facilitates an investment in scale and technology which will also help to drive future returns from agriculture.

Agriculture’s role in a well-diversified portfolio

In addition to the solid long-term or “secular” demand outlook for agriculture, there are other compelling reasons for investors to consider agricultural exposure as part of a well-diversified investment portfolio.

Irrespective of short-term commodity price movements, investing in Australian agriculture offers investors:

- Competitive risk-adjusted returns

- A lower level of volatility

- Returns uncorrelated to other traditional asset classes; and

- Defensive characteristics in certain market cycles.

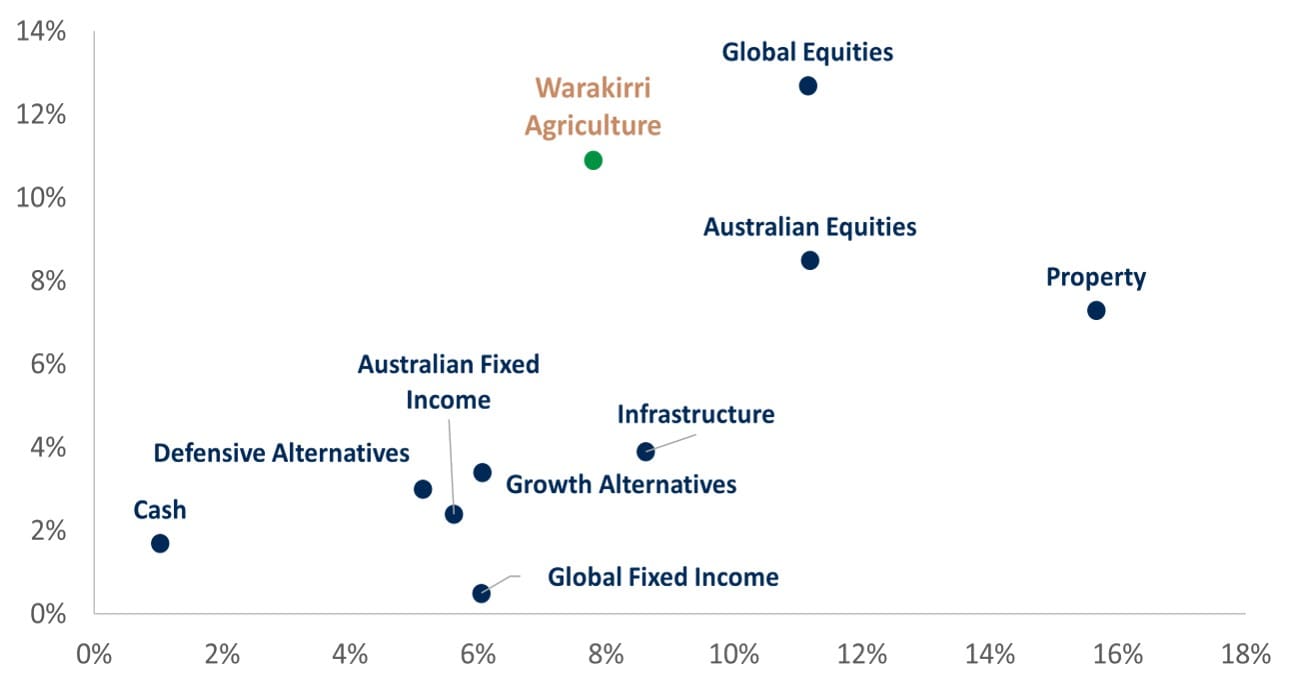

Agriculture, managed well, has a track record of producing competitive risk adjusted returns with relatively low levels of volatility. For the purposes of this paper, we use the example of the returns on one of Warakirri’s agricultural investment portfolios¹ as a proxy for the asset class and provide a comparison with index returns across other asset classes over the same period.

Asset Class Returns – 10 Years to 30 June 2023¹

Source: Warakirri Asset Management, Bloomberg, MSCI. Returns are unlevered, before fees and taxes.

With the exception of Global Equities, over the 1 and 10 year periods, Warakirri’s agriculture portfolio has outperformed the other major asset classes for the period ended 30 June 2023.

It is also worth noting the relatively strong performance of agriculture versus all other asset classes in FY20/21 which includes the period of high volatility resulting from the COVID-19 pandemic. A similar experience was also replicated during the Global Financial Crisis throughout 2008-2010.

And while it can be easy to focus on the headline return figures, the chart below shows that the agriculture portfolio also delivered better risk-adjusted returns than most other asset classes over this period.

10 Year Asset Class Average Return and Volatility (2013 to 2023)

Source: Warakirri Asset Management, Bloomberg

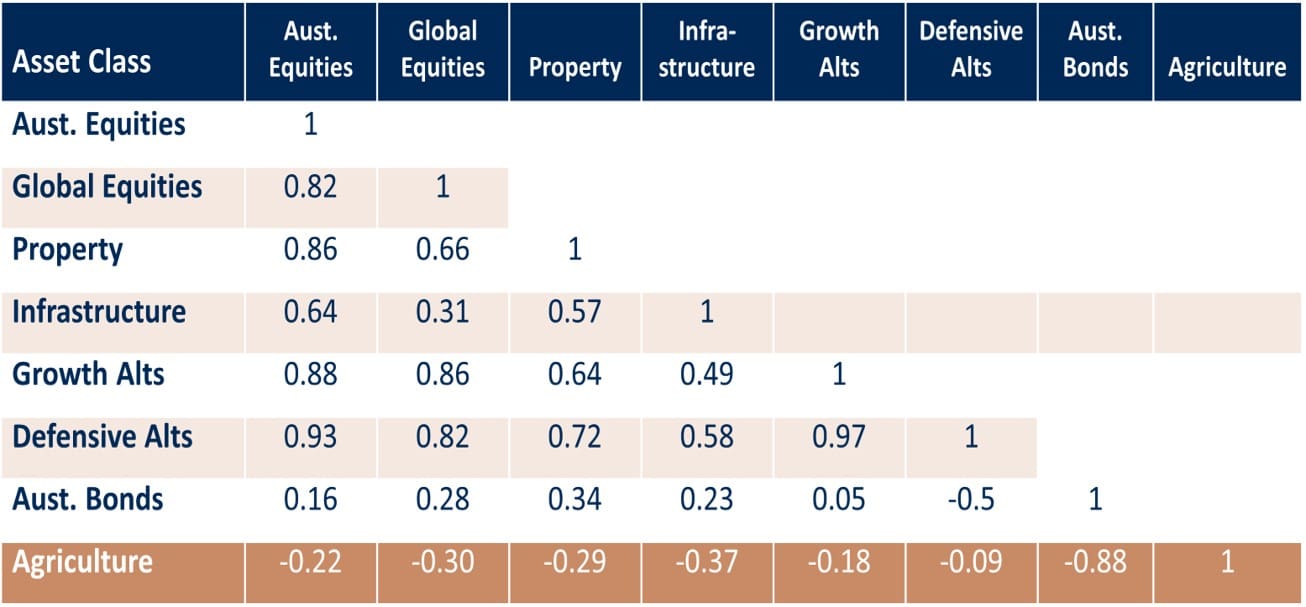

We know that investors should seek low asset class correlations to achieve a sufficient level of diversification. As shown in the table below, due to the relatively low correlation between agricultural sector performance and other asset classes more broadly, some exposure to the agriculture sector offers a good source of portfolio diversification for investors, in addition to competitive returns.

Asset Class Correlations

Source: Warakirri Asset Management, Bloomberg

AT A GLANCE: AUSTRALIAN AGRICULTURE

- Value of production in 2023-24 A$80 billion

- 2.7% of value added (GDP)

- 55% of Australian land use (426 million hectares)

- 72% of agricultural products are exported

- 13.6% of Australia’s total exports in 2022-23

- 87,800 Australian agricultural businesses

- Average emissions intensity of Australian cattle and grains producers is estimated to be below the global average

Agriculture in different economic cycles

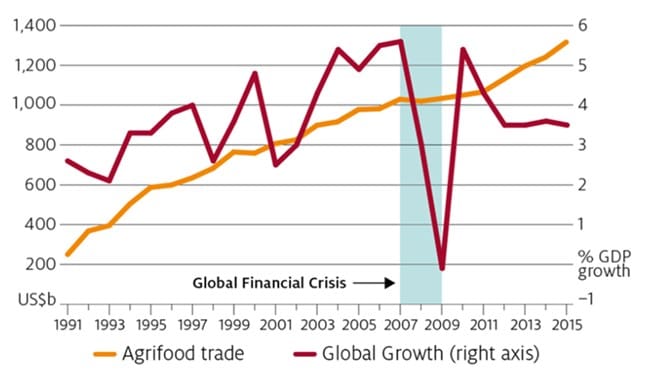

Agriculture returns also behave differently than traditional asset classes in various economic conditions and can offer important defensive characteristics to investment portfolios. As an example, during the Global Financial Crisis, not only did the prices of some goods fall much more than others – agricultural products experienced the smallest declines while oil and minerals experienced the largest – but global trade in agricultural products continued to grow over the period of the Crisis and beyond (see chart below).

Global Trade in Agricultural Products during the Global Financial Crisis

Source: Greenville, et al. (2019), IMF

Notes: Trade data discounted by IMF food price index.

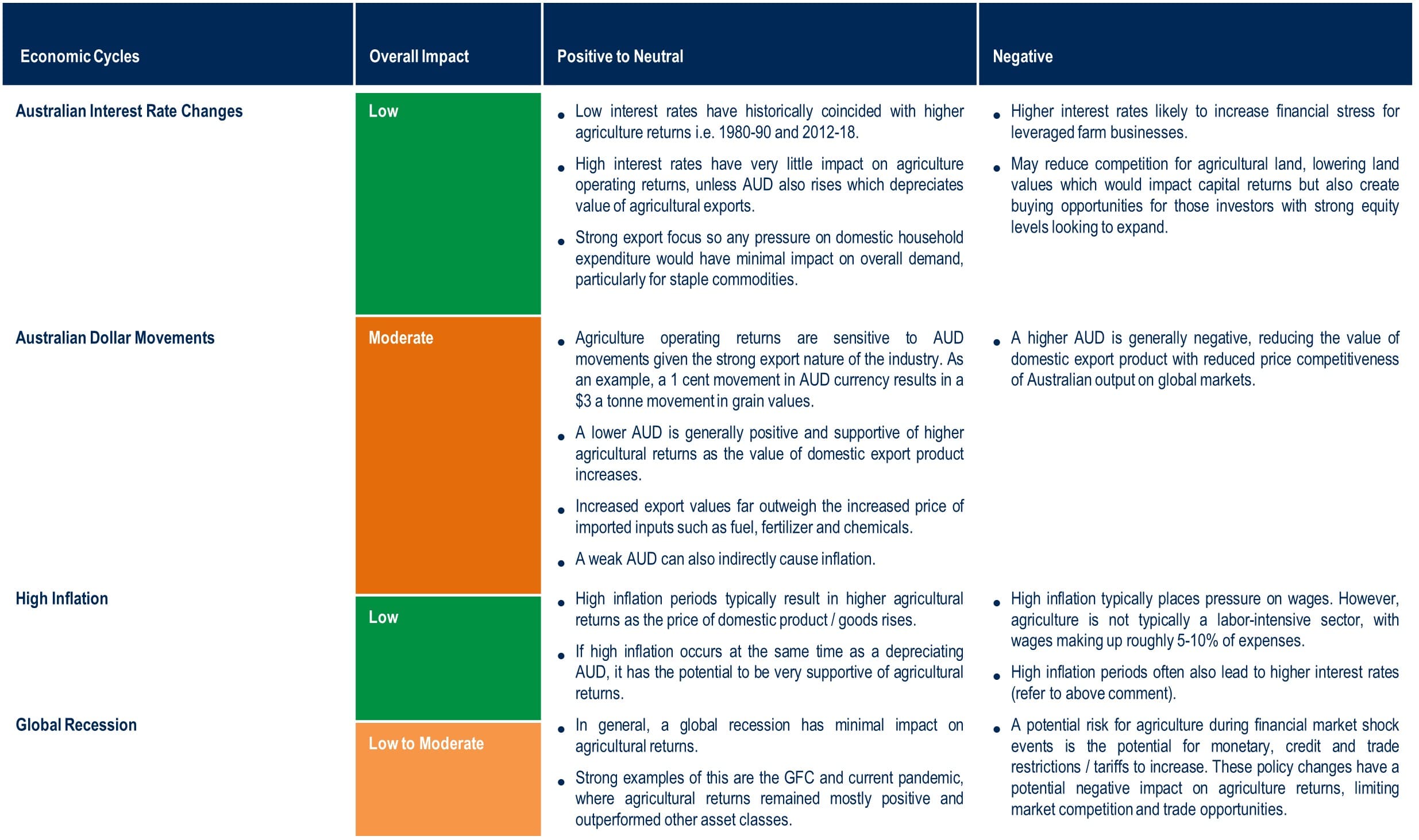

Below we provide a summary of agricultural return characteristics in the following key economic scenarios

- Changes in interest rates

- Australian dollar movements

- Periods of high inflation; and

- Global recessions

Economic Cycle Impacts on Agriculture Returns

Summary

The global thematic of rising populations, increasing wealth and changing population demographics is not new, but the opportunities for agriculture have not always been as clear as they are today. An increasing global demand for food, particularly in Asia, provides an opportunity for Australian agriculture to capitalise on its competitive advantages and future growth prospects to deliver competitive risk-adjusted investment returns.

Access to the agriculture sector has generally been the preserve of large sophisticated investors and institutions due to the need for specialised trading accounts, high minimum investment hurdles and well-developed skills to carefully manage the risks involved.

However, for those investors looking for simple access to a diversified portfolio of investment grade Australian agricultural assets, Warakirri’s range of diversified agriculture funds offer ‘Core Agricultural Property’ investment strategies that have been established to buy, develop and lease to high quality agricultural businesses (tenants) with target assets including higher value sectors such as horticulture (nuts and fruits), viticulture (wine and table grapes) and water entitlements. Importantly, the funds utilise Warakirri’s Sustainability Framework and includes, where possible, strategies to measure, monitor and reduce energy use, carbon emissions and improve biodiversity.

For more information please contact us on 1300 927 254 or visit our Warakirri Agriculture page.

-

- Warakirri Agriculture refers to a composite of the returns of broadacre cropping farms, dairies and diversified agriculture portfolios managed by Warakirri on behalf of a range of clients.

- Source: United Nations, The Global Financial Crisis and Its Impact on Trade, September 2010.

This information has been prepared by Warakirri Asset Management Ltd (ABN 33 057 529 370) (AFSL 246782) to provide general information for Wholesale investors only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. Warakirri Asset Management is not a taxation advisor and you should consult appropriate professional advisors on any taxation, legal, stamp duty and accounting implications of making an investment in any Warakirri fund or service. Further, the content within this document is not an offer or solicitation to enter into any agreement of any kind or intended to have that effect.

Full information about the Warakirri Farmland Fund and Warakirri Diversified Agriculture Fund is available in the Information Memorandum issued by Warakirri which can be accessed at warakirri.com.au. Past performance is not indicative of future performance.