Data Centre Demand – Byte-ing off more than it can chew?

22 May 2024

There has been a lot of excitement about the impact of AI, with the market re-rating data centre exposures as potential beneficiaries. What is less appreciated is the potential for significant supply constraints from power availability. Here our expert investment partner, Northcape Capital, discusses the implications and where they think the opportunities lie from this growing thematic.

This information has been prepared by Northcape Capital, the underlying investment manager for the Warakirri Ethical Australian Equities Fund and the Warakirri Concentrated Australian Equities Fund.

The AI Wave

While the concept of artificial intelligence (AI) has been around since the 1950s and use cases of machine and deep learning have been around since the 1990s and 2000s, it has been the development of generative AI in recent years that has truly captured the public’s imagination of what is possible with the technology.

To be sure generative AI is an enormous step forward in the history of AI. Rather than just classifying or analysing existing data, generative AI can create entirely new content. Companies can also now build their own customised models on top of foundational models, with tremendous potential for quickly adapting to numerous downstream tasks without the need for task-specific training from scratch.

For all kinds of users generative AI will enable groundbreaking efficiency and creativity. Enterprises can automate specific tasks and shift their energy, time and resources to more strategic goals, reducing labour costs, optimising operations and unlocking insights into their processes. Generative AI tools will also help them to create new ideas, edit, research and more.

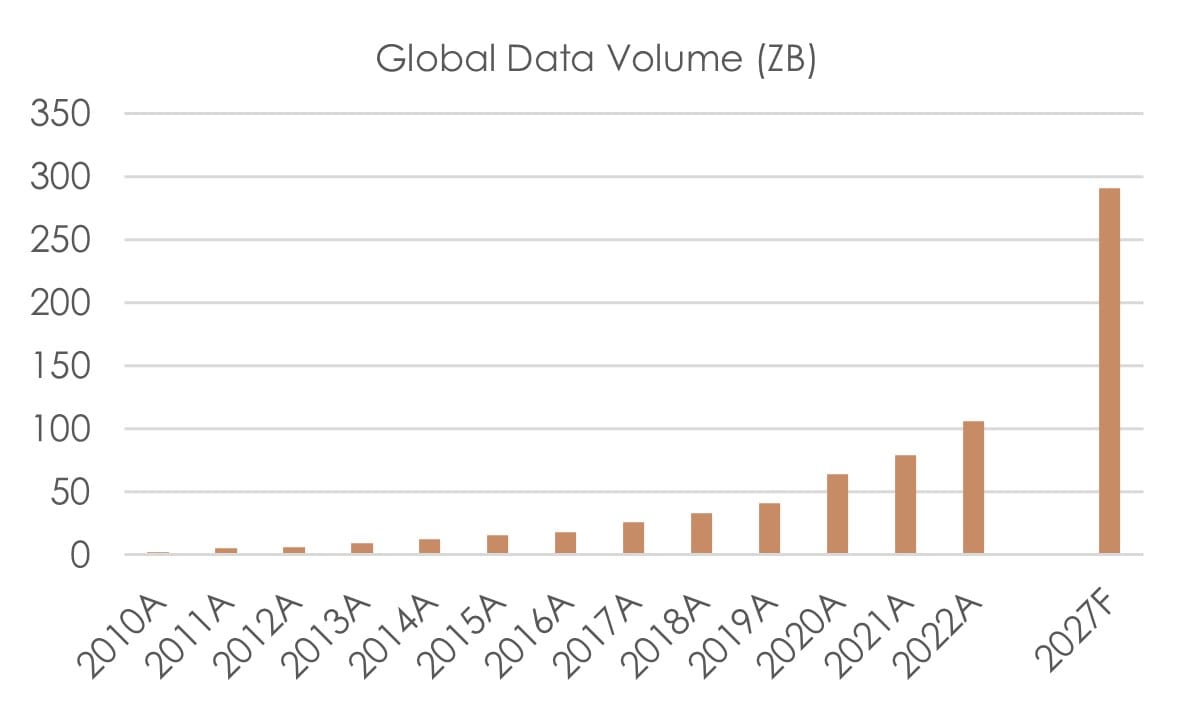

The use cases are almost endless and as the world of artificial intelligence booms, so will its appetite for data and computing power. Importantly, data and power is needed not only in the initial phase to train these models but also to process live information to make predictions or produce conclusions, which potentially requires an order of magnitude higher computing power as cloud players like CoreWeave have noted. Indeed, global data volumes are forecast to reach ~300 trillion gigabytes (300ZB) in 2027, almost triple the last reported figure in 2022, and up ~150x since 2010.

Equity market reaction

Given this backdrop and various industry descriptions of this technological advancement as the “next megatrend”, the “largest technological wave we have ever seen”, and the driver of the “fourth industrial revolution”, the equity market has responded to any potential beneficiaries with great enthusiasm.

Figure 1: Global Data Volume Forecast

Source: IDC Worldwide Global DataSphere Forecast; Statista

NVIDIA is the obvious poster child of this globally. They are the leading producer of the GPU chips that help process the data behind these AI models and its share price has more than doubled over the past year to become a A$3trillion company, the 3rd largest in the world.

Figure 2: NVIDIA vs S&P500 1 year share price performance to Mar 2024 (base=100)

Source: IRESS

Naturally this enthusiasm has spilled over to Australia. Companies with data centre assets that can potentially house the servers processing these AI models like NEXTDC (NXT) and Goodman Group (GMG) have been bid up, as the market anticipates a surge in demand for data centre capacity as AI adoption accelerates. The thinking goes, they are the modern-day shovels in the AI gold rush and we are in for a period of hyper growth. What could go wrong?

Figure 3: NXT & GMG vs S&P300: 1 year share price performance to Mar 2024 (base=100)

Source: IRESS

Watt’s the deal with all that power?

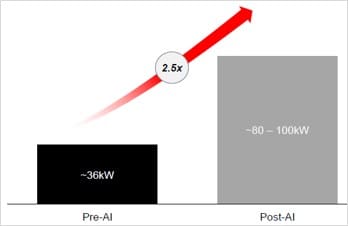

For data centre capacity to grow, they need power – lots of it. AI workloads are power intensive with average power density 2.5x larger than non-AI workloads, and overall global data centre capacity is forecast to more than double in the next 4 years.

Figure 4: Average power density per rack

Source: NXT

This is a huge undertaking, and the potential supply side constraints are not trivial. A 300 MW data centre (equivalent to NXT’s S4 development in Sydney) consumes electricity equivalent to ~200,000 developed world homes, with a direct physical footprint of about 100,000 square meters. This requires a large amount of infrastructure to support it, likely including its own sub-station and multiple transmission lines for redundancy.

As an illustration, supporting a 300 MW data centre with renewable energy in the form of solar, will likely require the generation capacity broadly equivalent to the 1.3GW Upper Calliope solar farm in Queensland, Australia’s largest ever solar project.

This solar farm will use over 27 million sqm of land (~200x the footprint of the data centre itself), take 2-3 years to complete (assuming it gets approved) and we estimate would cost in the order of $2bn (an additional ~50% of the cost to build the data centre itself). It would also rely on additional firming power which is increasingly under pressure at the grid level and will eventually have to be provided and paid for.

Added to this are the system wide implications of a ‘new’ and growing electricity consumption category. As an example, Australia’s aggregate electricity generation has broadly flatlined over a decade ago, and the stability of the system is challenged by the rapid growth of intermittent renewables as a replacement for base load power.

Data centre growth is creating a significant inflection point in required system wide infrastructure spend, simultaneous to energy transition plans that require wholesale replacement of the existing generation and transmission line infrastructure.

We estimate data centres in Australia make up ~2-3% of current grid demand today but will grow 7x that amount on current planned capacity alone. Assuming just the closure of the Eraring coal station alone (slated for next year), that will remove almost the same amount of firm power from the grid i.e. an incremental ~6GW of effective capacity drawdown (note current grid capacity is ~50 GW servicing peak demand of ~30 GW).

Already we have seen sporadic moratoriums in some offshore locations on data centre developments (e.g. Singapore, Ireland, Netherlands). Even in the case of Singapore, where the moratorium was recently lifted after being in place for 3 years, new capacity allowed across the industry has since only been 80MW (vs. installed capacity of ~1000MW) given the ongoing constraints of power supply.

Data centre growth is creating a significant inflection point in required system wide infrastructure spend, simultaneous to energy transition plans that require wholesale replacement of the existing generation and transmission line infrastructure.

We estimate data centres in Australia make up ~2-3% of current grid demand today but will grow 7x that amount on current planned capacity alone. Assuming just the closure of the Eraring coal station alone (slated for next year), that will remove almost the same amount of firm power from the grid i.e. an incremental ~6GW of effective capacity drawdown (note current grid capacity is ~50 GW servicing peak demand of ~30 GW).

Already we have seen sporadic moratoriums in some offshore locations on data centre developments (e.g. Singapore, Ireland, Netherlands). Even in the case of Singapore, where the moratorium was recently lifted after being in place for 3 years, new capacity allowed across the industry has since only been 80MW (vs. installed capacity of ~1000MW) given the ongoing constraints of power supply.

In our view electricity capacity will likely form a significant constraint on exponential AI related demand, particularly given the political implications around energy access and grid stability, and energy transition commitments.

Whilst it is possible excess demand is absorbed into a rising price of compute power and downstream activities, this will be limited by use case and likely insufficient to offset the accelerated quantity expansion the market is anticipating.

Portfolio Implications

NextDC (NXT)

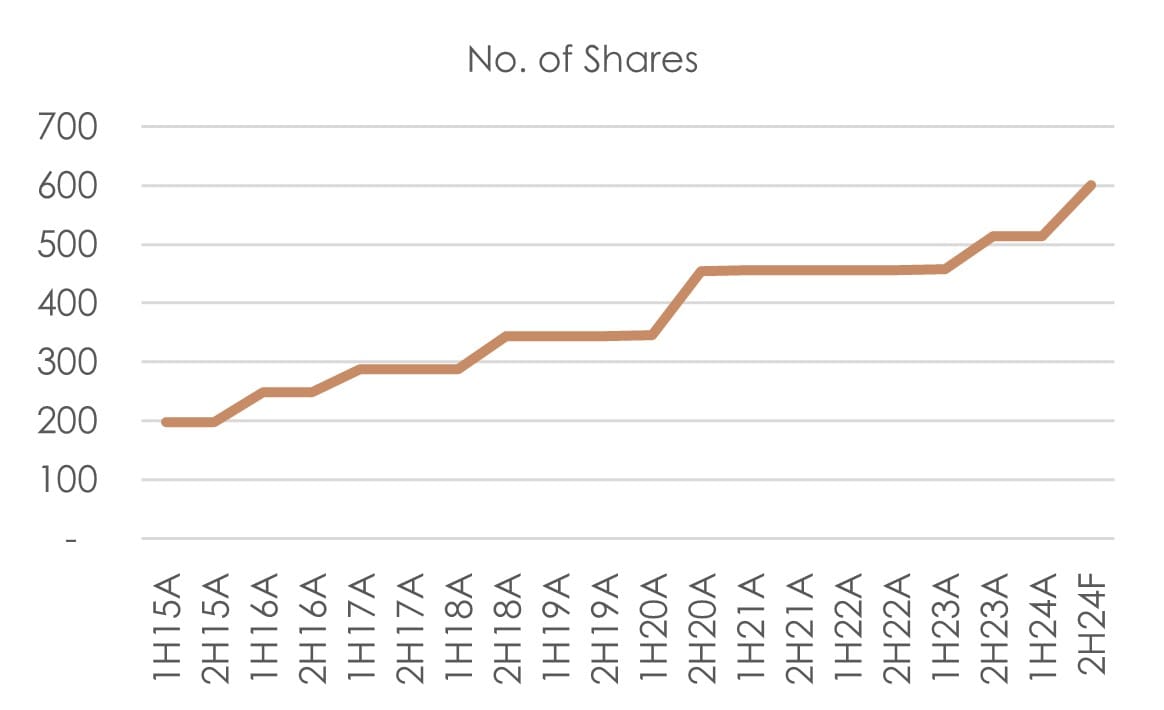

NextDC is a capital-intensive business. It has a history of raising equity to fund its operations (shares on issue have tripled in less than a decade, a 13% CAGR) and just this month raised another $1.3bn (~17% of its share base) to help fund its expansion activities on the back of the aforementioned anticipated demand. We remain cautious on funding this for a number of reasons.

Returns in the industry are generally mediocre. Equinix, a more mature overseas peer has historically generated a CFROI of just ~6%. NXT’s own commentary suggests returns for hyperscale centres are in the high single digit to low double-digit range.

Even at face value we don’t think that is particularly compelling considering the large amounts of upfront capital that needs to be deployed, the long payback period and rising holding costs.

Figure 5: NXT Share Count

Source: NXT, Northcape

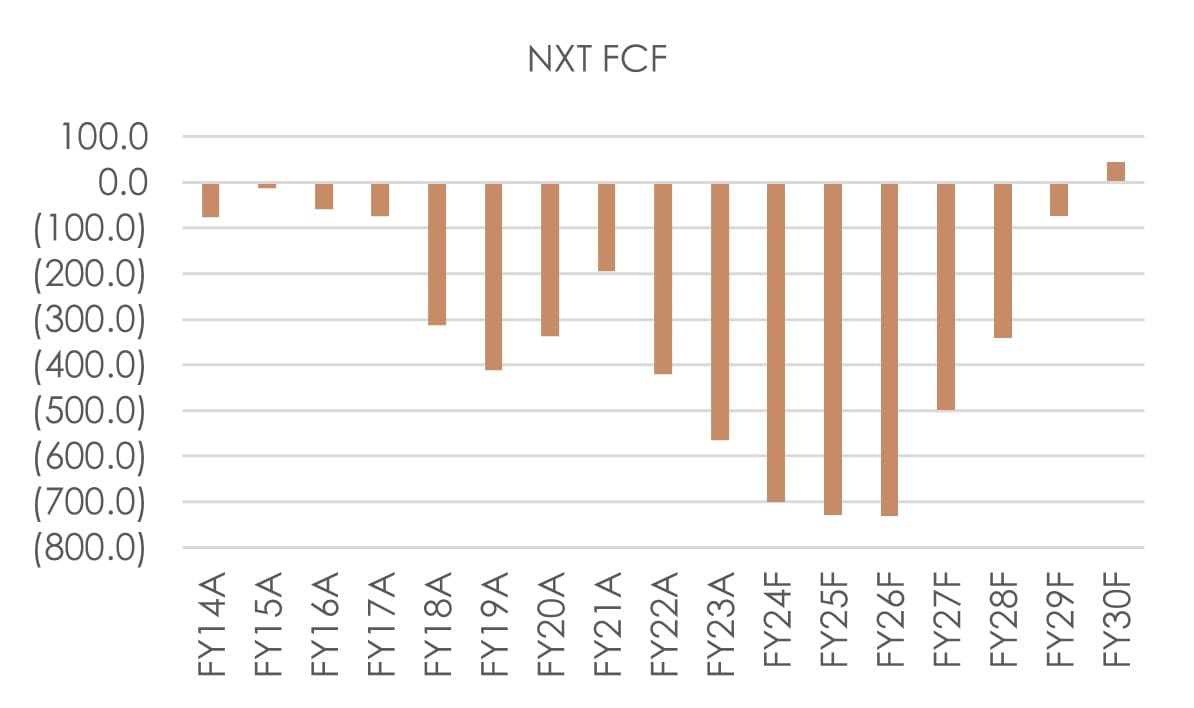

Consensus numbers suggest Free Cash Flow break-even only by the end of the decade, and even that potentially understates the likely capex profile given management’s commentary on prioritising and accelerating development in all their major markets.

Figure 6: NXT Free Cash Flow

Source: NXT, Northcape, Visible Alpha

Of additional concern to us is that the capital expenditure is increasingly skewed towards hyperscale and offshore markets where the returns are even lower and their relative competitive position worse. The capex deployed today requires very strong demand to sustain post 2030 and any miscalculation on the long-term demand and supply curves can be very costly.

Given their portfolio of long duration assets, valuation is highly sensitive to key assumptions. We note for example, that offshore peer Equinix has recently been subject to a short report, alleging amongst other things the legitimacy of the capital expenditure classified as growth rather than maintenance. Technological developments (e.g. in cooling methods) can also impact long held assumptions on depreciation for example.

Yet despite low visibility into NXT’s financials (we also note for example that the largest use of funds in their recent capital raise was $862m for “general corporate purposes”) and the ultimate long term returns available, the market is currently paying a very high multiple.

Figure 7: NXT Use of Funds in April 2024 – Capital Raise Presentation

Source: NXT

Whilst it may be easy to be enamoured by the rise of NVIDIA and hope to gain some proxy exposure through NXT, we highlight that NVIDIA has an extremely high economic moat (noting that NXT is expanding into Asia as a new entrant); generates very high returns; has seen its forward earnings revised significantly upwards (from $6 in May 2023 to $24 currently vs. NXT which is currently loss making); and has been buying back its stock (vs. NXT being a serial consumer of capital as aforementioned).

In our view assessing each stock on its own merits rather than chasing the latest trends is essential to delivering long term performance.

We also note that NXT’s management targets have no return hurdles and are focused on revenue, EBITDA, project delivery and the share price – incentivising them to continue to grow at pace. The CEO’s shareholdings have also declined significantly over time. Whilst there may be legitimate reasons for liquidating stock, it does reduce the alignment of management with long term shareholders.

Of course, with NXT trading at a significant premium to its net tangible assets they should be issuing more capital – we just don’t want to be the ones paying for it.

Goodman Group (GMG)

Goodman Group is a leading global industrial property group. Its business model is based on owning, developing, and managing industrial property in key markets around the world. GMG has been successful in acquiring suitable urban in-fill sites and undertaking logistics or data centre developments. Goodman Group has been able to attract patient long-term capital from global pension funds and invest alongside these partners or retain an ownership interest on balance sheet.

Goodman has begun to pivot more to data centre developments in recent years and these now represent 37% of work in progress and will probably be > 50% within the next 2 years. Management have not released much detail on the data centre business model except the projected end value of the data centres could be $50bn.

Analysts have worked back from this number to calculate the implied total development profits and estimated the present value to be in the $10-11bn range. The share price has risen > 50% since the strategy was announced and appears to have more than captured this potential upside.

The AI thematic will probably remain a strong one and could continue to drive GMG’s share price higher from the current level. However, we are cautious on the stock on a number of fronts:

- Goodman’s business model appears to be changing whereby it is accepting a higher level of risk by capturing more of the development upside. While this may prove successful, the additional risk does not appear to be reflected in analyst valuation models.

- Development earnings now contribute > 50% of Group profit and these are more volatile and less sustainable than other income streams such as management fees and property investment income.

- There is little global evidence of data centre REIT’s generating an above average return on capital. Limited barriers to entry and a potential step up in maintenance costs over the life of the asset could further constrain ROIC.

- We also have concerns about availability of power required for the build out of data centres and whether this could extend the development pipeline beyond the expected 5-7 years.

Portfolio Activity

Given our concerns above, we are underweight (no holdings) both NXT and GMG.

We have instead been adding to both BHP and Evolution Mining (EVN).

Both these producers have significant exposure to copper (we estimate ~30-40% of normalised medium-term profits for BHP ex-Anglo American potential contribution and ~30% for EVN), a critical element used to conduct electricity (and heat) that is used extensively not only in data centres and power generation and distribution (and hence will also stand to benefit from any sustained AI driven demand) but also from the ongoing electrification of our world, from EVs to wind turbines and solar panels.

Importantly, the global supply of copper is constrained, with a lack of much needed new large-scale mine discoveries and development, ore grade quality declines and operational issues at various global producers. This should bode well for the long-term price outlook but even at current spot prices, both generate strong free cash flow and yet still trade at reasonable levels (high single digit to low double digit FCF yields for BHP and EVN respectively).

While there has been a lot of excitement about the impact of AI, with the market re-rating local names like NXT and GMG, we think the potential for significant supply constraints from power availability is high and underappreciated in the market.

Further, long term returns are uncertain and moderate at best and upfront capital investment is extremely high. Any miscalculation on long-term demand forecasts will have significant financial implications. With valuations elevated, we think the risk versus reward is poor and prefer to have exposure through commodity producers like BHP and EVN who will benefit from higher copper prices should AI driven demand sustain at high levels and are generating strong free cash flow already today.

For more information, please contact us on 1300 927 254 or visit the warakirri.com.au.

The information in this document is published by Warakirri Asset Management Limited ABN 33 057 529 370 (Warakirri) AFSL 246782 and issued by Northcape Capital ABN 53 106 390 247 AFSL 281767 (Northcape) representing Northcape’s views on a number of economic and market topics as at the date of this report. Any economic and market forecasts presented herein is for informational purposes as at the date of this report. There can be no assurance the forecast can be achieved. Furthermore, the information in this publication should only be used as general information and should not be taken as personal financial, economic, legal, accounting, or tax advice or recommendation as it does not take into account an individual’s objectives, personal financial situation or needs. You should form your own opinion on the information, and whether the information is suitable for your (or your clients) individual needs and aims as an investor. While the information in this publication has been prepared with all reasonable care, Warakirri and Northcape do not accept any responsibility or liability for any errors, omissions or misstatements however caused.