Can GLP-1s solve the world’s obesity problem?

22 May 2024

The integration of GLP-1s, a class of drugs initially used for diabetes management, into healthcare systems has the potential to revolutionise the landscape of obesity management and create healthier societies, but the question lies in whether they have the power to solve the obesity epidemic? Here our expert partner, Northcape Capital, delves into the obesity crisis, the advantages and hurdles of this new therapeutic approach and how investors can capitalise on the opportunity.

This information has been prepared by Northcape Capital, the underlying investment manager for the Warakirri Ethical Global Equities Fund.

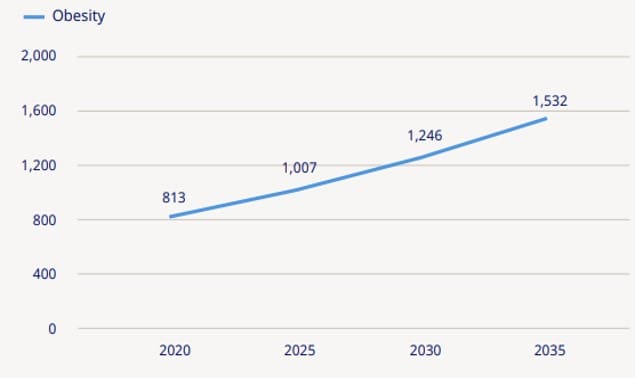

The Rising Prevalence of Obesity

The rising prevalence of obesity has fast become one of the greatest health challenges we will likely experience in our lifetime. Since 1975, obesity rates have nearly tripled worldwide, with a substantial increase in the number of adults and children affected by this condition. Over 900 million adults or 16% of the global population are living with obesity today but this is substantially higher in many countries including the US at 45%, highlighting the pervasive nature of this issue. Unfortunately, this is not the endpoint as the global obesity rate is projected to double by 2035.

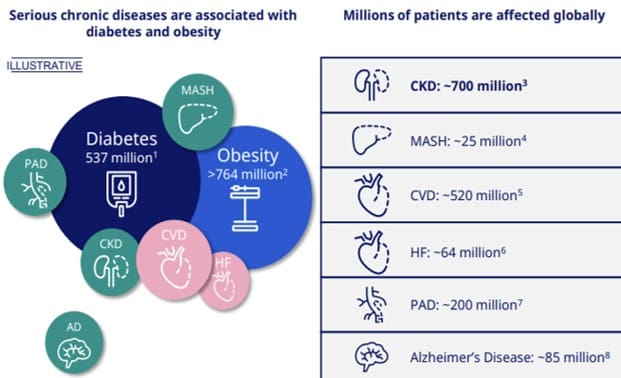

The impact of obesity is extensive, contributing to over 200 medical conditions, including cardiovascular diseases, sleep apnea, kidney disease, osteoarthritis, diabetes, and various forms of cancer. It’s crucial to note that obesity is not just a matter of weight but a complex health issue with multifaceted causes and consequences.

Exhibit 1: Global prevalence of obesity (adults in millions)

Source: Novo Nordisk, Obesity Atlas

Exhibit 2: Strong overlap across several chronic diseases

Source: Novo Nordisk, 2022

The fact that over 90% of individuals with obesity experience multiple comorbidities underscores the urgency for effective prevention and treatment strategies to improve health outcomes and quality of life for those affected. But addressing this epidemic requires a multifaceted approach, including public health initiatives, policy changes, cultural adjustments and perhaps most importantly a paradigm shift in the treatment of the condition as a chronic disease.

Cost Burden to Society

Beyond the health consequences for an individual, obesity has far-reaching consequences for societies. The increased risk of health conditions leads to higher associated direct medical costs. Moreover, obesity has indirect economic costs associated with mental health issues, reduced productivity and greater socioeconomic disparities, which can place strain on public health budgets and impact global economies. We will address each of these below.

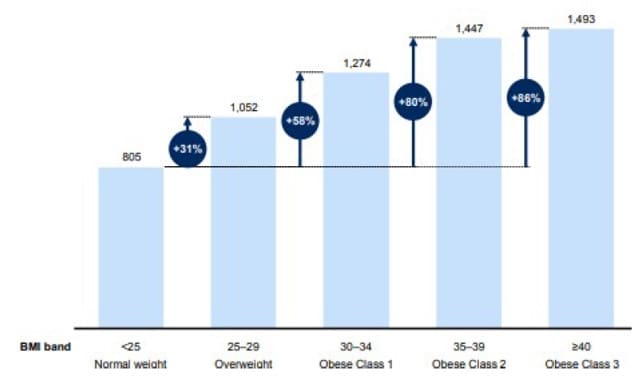

Paying extra pounds for the pounds:

The societal cost of obesity is extensive and difficult to measure, as it includes both the direct medical costs as well as the indirect economic burden. A Milken Institute study conducted in 2016 estimated that the US annual economic cost from obesity (including direct and indirect costs) was over $1.72 trillion (9.3% of GDP), which is likely higher today given the 3-4% rise in prevalence since then. Unsurprisingly, the direct medical cost burden rises exponentially with higher rates of obesity, with 60-80% higher costs or ~$1,500 per annum for those with obesity. The World Health Organisation (WHO) estimates that obesity has a staggering 2.4% impact on global GDP.

Exhibit 3: Rising medical costs with increasing levels of obesity

Source: Morgan Stanley Research, McKinsey study (2014)

Tipping the income inequality scale:

Obesity has been shown to exacerbate socioeconomic disparities. There is a growing prevalence of obesity in lower and middle-income socioeconomic groups, where access to healthy food alternatives is limited and packaged and unhealthy foods are sadly often more affordable. Furthermore, an economist study highlighted a concerning pattern of pay inequality linked to obesity, with overweight women earning lower salaries and those with severe obesity experiencing up to a 10% income reduction.

Downsizing life expectancy:

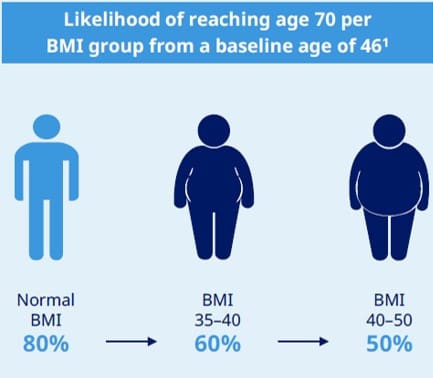

Research shows that being overweight or obese, radically reduces life expectancy in adults by around 5-10 years, due to the health-related consequences. According to WHO, obesity is responsible for 5% of global deaths and is the second most preventable cause. Lower quality of life in the latter years is also highly probable.

Exhibit 4: Lower life expectancy with obesity

Source: Novo Nordisk

Solving the Obesity Epidemic

The FDA’s approval of Wegovy in 2021 marked a significant milestone in obesity management, recognising it as a serious medical condition and reshaping how it is treated. Developed by Novo Nordisk, Wegovy is part of a new class of GLP-1 drug treatments designed for chronic weight management. It builds upon the legacy of Saxenda, a less effective GLP-1 weight loss drug and shares the active ingredient Semaglutide with diabetes medication Ozempic, albeit in varying dosages. In part thanks to social media, the demand for these new ‘miracle drugs’ has been unprecedented, highlighting the desperation of those struggling with obesity and its consequences to find a solution beyond just lifestyle modifications.

As the market for GLP-1s expands, with estimates suggesting it could reach $100 billion by 2030, there are exciting investment opportunities emerging. Before delving into these, we will discuss the background to GLP-1s and outline the benefits and disadvantages of their ability to solve the obesity epidemic.

What is a GLP-1?

GLP-1 agonists are a revolutionary class of medications that have transformed the management of type 2 diabetes and more recently obesity. By emulating the natural hormone “glucagon-like peptide 1”, they play a crucial role in regulating blood sugar levels post-meal. Their ability to slow gastric emptying not only helps in controlling blood sugar spikes but also aids in weight management by reducing appetite and caloric intake. Furthermore, they contribute to the health of pancreatic beta cells, which are essential for insulin production, thus delaying the progression towards full insulin dependency.

It is worth noting that these drugs have been around since 2005, for the treatment of type 2 diabetes. Their surge in popularity over the last 2 years can be attributed to their effectiveness in weight reduction, a significant advantage over legacy diabetes medications that could lead to weight gain. But perhaps more importantly, the overall health benefits they offer and initial breakthrough expansion of insurance coverage in the US, along with reimbursement policies in other countries, have made them more accessible to patients seeking both diabetes treatment and weight management solutions. We will review each of these benefits in more detail.

Benefits of the New Wave of Obesity Treatment

1) Larger weight loss outcomes

One of the more significant benefits of the newest class of drugs is the improving weight loss outcomes. The evolution of GLP-1 treatments for obesity and diabetes represents a significant advancement in medical therapies. The newer generation of these drugs, such as Novo Nordisk’s Wegovy and Ozempic, and Eli Lilly’s Zepbound and Mounjaro, have demonstrated remarkable improvements in weight loss outcomes, nearly tripling the efficacy of previous treatments towards 15-20% weight loss. With ongoing research and development, these companies are not only enhancing drug effectiveness towards 20-25% but also focusing on patient-centric treatment options, including oral medications and various injectable dosages, to better meet individual health requirements.

2) Big gains in health benefits

GLP-1 receptor agonists have been shown to not only slow gastric emptying and improve insulin secretion, but there are other positive health impacts on the heart, liver, brain and kidneys. Novo Nordisk’s Select trials of Wegovy have shown several improved healthcare outcomes. These include a 20% improvement in risk of developing cardiovascular diseases, which includes lowering blood pressure and blood lipid levels; an 18% reduction of heart failure; 22% reduction of progression towards kidney disease/dialysis; and a 19% reduction of all causes of death.

Encouragingly, there was a notable 37% reduction in a broad composite of diseases, including stroke, cardiovascular disease and diabetes.

These benefits are considerable but this is only the beginning, as both Novo Nordisk and Eli Lilly are undergoing further clinical trials to understand the impact on other comorbidities including Parkinsons, Alzheimer’s, osteoarthritis and sleep apnea.

3) Insuring the masses

As demand for GLP-1s has surged, fuelled by their profound improvement in health outcomes, we have seen a shift in corporate and government willingness to provide coverage. In the US, there are currently 50 million people with access to Wegovy, including 38 million through commercial insurance plans and 12 million through Medicaid within 18 states.

In March 2024, we began to see the first signs of hope for broader obesity reimbursement, when the FDA widened the approved use of Wegovy to include a reduction in the risk of heart conditions in people with obesity following the positive trial data. As such, Medicare Part D drug-benefit plans announced plans to cover Wegovy for overweight patients at risk of heart disease. While this covers subset of around 11 million people, directionally it shows that selective reimbursement is likely to expand.

Currently 80% of adults with type 2 diabetes are also overweight or obese. GLP-1s are reimbursed in the US and in many other countries, for the treatment of diabetes and therefore may be the most obvious route to access for these individuals until such time that reimbursement for obesity improves. In the meantime, for those that are not diabetic, coverage is likely to broaden through greater corporate insurance and selective reimbursement based on favourable trial outcomes.

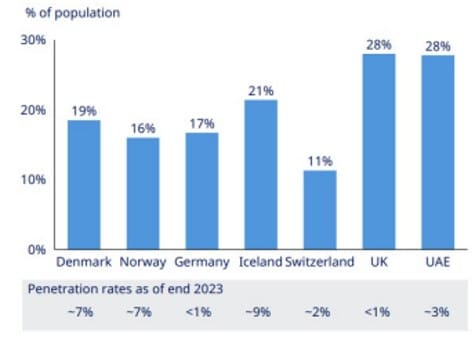

The landscape of anti-obesity medication is evolving, with Wegovy now available in several countries outside of the US, including the UK, Denmark, Norway, UAE, Japan, Switzerland, Iceland and Germany with varying reimbursement policies influencing access. While around 80% of treatments are currently borne by individuals, efforts are underway to enhance insurance coverage, which could lead to broader usage and accessibility.

Exhibit 5: Strong uptake of Wegovy internationally

Source: Morgan Stanley research

Challenges to Solving the Obesity Epidemic

1) Nauseating side effects

A key barrier to GLP-1s solving the world’s obesity problem is the tolerability of these drugs. The more common short-term side effects include nausea, diarrhoea, heartburn, and stomach pain. A Bank of America study showed that most patients taking Wegovy experience some form of side effect, particularly in the first 2 months. Encouragingly, around 70% of patients found these side effects to be manageable, perhaps suggesting that tolerability is less of a prohibiting factor to persisting with treatment.

Adherence to long-term medication regimens, such as those for weight loss, is crucial for achieving the desired outcomes. Novo Nordisk data indicates that a third of patients have maintained their treatment with Wegovy over a year which is encouraging, as it aligns with adherence rates for other chronic conditions. Addressing common barriers to treatment continuation, like drug availability, side effects, and financial factors, is essential for improving patient compliance and ensuring sustained benefits from these medications.

When it comes to the longer-term implications of the treatment, which some argue is unchartered territory, we should recall that GLP-1s have in fact been in the market for almost 20 years. Therefore, the long-term side effects are well documented and appear to be limited. Amongst some of the more serious potential longer term concerns are that they are not recommended for those predisposed with a history of thyroid or pancreatic cancers as early studies suggested an increased risk of thyroid and pancreas tumours.

2) No Free Lunch

As a precursor to improving societal healthcare outcomes, the drug will need to be made more widely available and affordable. The price of these drugs is currently high, particularly in the US, where 55% of those living with obesity are paying out-of-pocket.

The financial implications of fully reimbursing anti-obesity medication in the US are indeed significant and frankly unattainable. Based on the current list price, the estimated cost of full reimbursement would cost $1.6 trillion, a substantial portion of the US healthcare budget. As we see it, the only way to fully integrate these treatments into the healthcare system sustainably is for pharmaceutical companies to substantially reduce their prices, which seems unlikely near term in the face of supply constraints, or for selective reimbursement targeting specific comorbidities to gradually improve access.

3) Building supply inch by inch

The unprecedented demand is outstripping supply. It is fair to say that the main challenge shorter term will be to meet the demand with sufficient supply. The main bottlenecks to date are related to the ‘fill and finish’ capacity, rather than sourcing of ingredients. As such, both Novo Nordisk and Eli Lilly have been accelerating capex investments with a combined $50bn to improve supply over the next 5 years. A typical organically built ‘fill-finish’ manufacturing plant takes around 3 years to reach full capacity, due to the complex and technical nature of filling the auto-injector device in a sterile environment. Novo Nordisk has focused efforts on outsourcing these capabilities with contract manufacturing and development organisations (CDMOs).

A more creative and less time-consuming way to navigate the supply challenges is to buy capacity outright. In February 2024 we saw this in action as the parent company of Novo Nordisk, Novo Holdings, entered into an agreement to acquire Catalent, a leading CDMO with 50 sites where Novo Nordisk will acquire 3 of these for $11bn. We estimate that Novo will have sufficient supply to serve 4 to 5 million patients by 2026, with a new wave of supply coming through the Catalent sites thereafter.

Finding Investment Opportunities in this Era of Therapeutic Care

The obesity drug market, currently valued at $6 billion, is projected to experience a significant expansion, exceeding $100 billion by 2030. Investment opportunities are diverse, ranging from direct investment in pharmaceutical companies leading the charge, to indirect investments in the supply chain. Additionally, the market’s evolution is expected to influence various sectors, with companies experiencing varying degrees of impact based on the resulting behavioural changes and health outcomes associated with obesity management. We will explore each of these in more detail.

1) Pharmaceutical companies

The investment opportunity that excites us most, as global investors, is the direct pharmaceutical beneficiaries. Danish listed Novo Nordisk (NOVOB DC) and US listed Eli Lilly (LLY US) are the frontrunners dominating the GLP-1 market. While we believe both companies are set to see tremendous growth from the revolutionary obesity opportunity, we added Novo Nordisk (NOVOB DC) to our portfolio. While both Novo Nordisk and Eli Lilly meet our 5 quality principles and could be considered for our Approved List, we prefer Novo Nordisk for its comparatively attractive valuation.

Novo Nordisk’s century-long expertise in diabetes care and their strategic investments in innovation and manufacturing capabilities have positioned them as a market leader. Despite the potential entry of new competitors, which are only in clinical trial phases of drug development, the current duopoly has strengthened their competitive moat and created a sustainable advantage. They are arguably years ahead in the development of products, which continue to improve with each new class, and have invested significant capital in shoring up manufacturing capacity which as we know is no quick process.

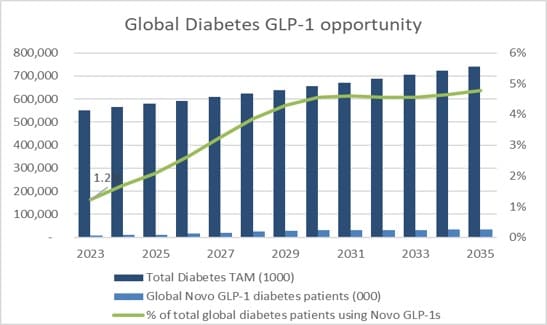

The company has two primary growth drivers. Firstly, diabetes care is an attractive growth opportunity, given it is 75% of current revenues and core to their strategy. Around 537 million people are living with diabetes which is expected to grow to 650 million or to 1 in 8 people by 2030. Only 15% of these patients are under good care and 50% remain undiagnosed. GLP-1s are in the very early innings of penetration, with only 6% of the US diabetic population using them (and only 1.2% globally!). We expect this to rapidly expand given the broad array of health benefits offered over alternative treatments. Given they are primarily reimbursed for diabetes, we believe the company will gain significant share of the $75bn diabetic drug market which is expected to grow to $100bn by 2030.

Exhibit 6: Significant opportunity in diabetes care

Source: Bloomberg, Northcape estimates

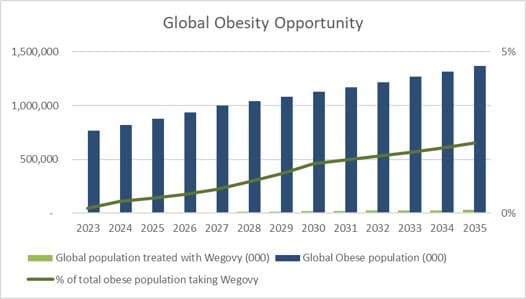

Secondly, within obesity care, we believe Novo Nordisk is one of the best positioned companies to capitalise on this opportunity. Only 1 million people are currently using GLP-1s for obesity treatment today which is 0.1% of the total addressable market. What’s more, our assumptions imply only 2% penetration by 2030 so there is a very long runway for growth. We believe that Novo can easily dominate 35% of the $100bn obesity drug market by 2030. Supply will continue to expand, organically and through the Catalent acquisition, and we expect pricing to reduce significantly across all markets allowing more people to access the drugs at a more affordable price.

Exhibit 7: Early days in the global obesity opportunity

Source: Bloomberg, Northcape estimates

2) Indirect Beneficiaries: Contract Manufacturers and Suppliers

We view Thermo Fisher (TMO US), a portfolio holding, as another beneficiary of this new wave of obesity care. Thermo Fisher is a global leading life science company with a strong contract manufacturing (CDMO) business. It was a strong beneficiary of COVID, given its ability to supply covid vaccinations around the world, however as the need for this supply wanes they have been able to repurpose some of the excess supply capacity to ‘fill-finish’ the GLP-1 injectable products. While this is not a significant part of their business, they are uniquely positioned with their global scale and capacity.

Secondly, Becton Dickinson (BDX US), a long-standing fund holding, is a key provider of GLP-1 autoinjector syringes for both diabetes and obesity. They can produce at a reduced cost given their significant global scale benefits. Becton has around 60% share of the $3bn market which is expected to grow strongly with the emergence of obesity drugs. While a small part of Becton’s total revenues, it should provide a tailwind to growth over the medium term.

Conclusion

As one of the greatest healthcare challenges of our lifetime, which has up until now largely been neglected, the emergence of therapeutic drugs to treat obesity as a chronic disease presents a very exciting investment opportunity.

The improving weight loss outcomes along with extensive and far-reaching health benefits will continue to improve with new emerging drugs and therefore should provide significant benefits to societal health outcomes. As responsible investors, we believe that addressing the obesity problem is essential to align with UN Sustainability goal 3 which ensures healthy lives and promotes well-being for all at all ages.

While we don’t believe that these drugs will solve the entire world obesity epidemic, due to the risks around tolerability, reimbursement and high drug costs, we do think it will be a meaningful growth driver for the direct pharmaceutical beneficiaries given the size of the total addressable markets and multi-faceted benefits these products offer and see further indirect opportunities to invest in companies building capacity or that have been oversold.

For more information, please contact us on 1300 927 254 or visit the warakirri.com.au.

The information in this document is published by Warakirri Asset Management Limited ABN 33 057 529 370 (Warakirri) AFSL 246782 and issued by Northcape Capital ABN 53 106 390 247 AFSL 281767 (Northcape) representing the Northcape’s view on a number of economic and market topics as at the date of this report. Any economic and market forecasts presented herein is for informational purposes as at the date of this report. There can be no assurance the forecast can be achieved. Furthermore, the information in this publication should only be used as general information and should not be taken as personal financial, economic, legal, accounting, or tax advice or recommendation as it does not take into account an individual’s objectives, personal financial situation or needs. You should form your own opinion on the information, and whether the information is suitable for your (or your clients) individual needs and aims as an investor. While the information in this publication has been prepared with all reasonable care, Warakirri and Northcape do not accept any responsibility or liability for any errors, omissions or misstatements however caused.